| 금시세(금값)…또 사상 최고치 주홍철 기자 jhc@kjdaily.com |

| 2024년 04월 04일(목) 08:00 |

|

오늘의 금시세(한국금거래소 0.47%↑, 한국거래소-KRX 1.91%↑)

국제 금값이 사상 처음으로 온스당 2300달러 선을 돌파하며 역대 최고치를 기록했다. 파월 연준 의장의 금리 인하에 대한 신중한 발언에도 금가격은 강세장을 이어갔다.

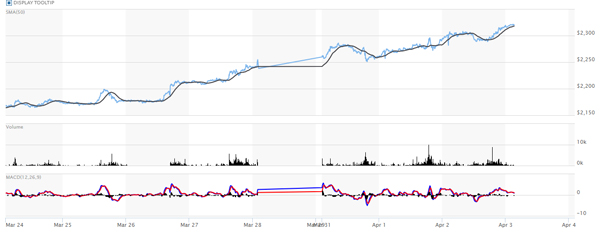

수요일(3일 현지시간) 뉴욕상품거래소(COMEX)에서 올해 6월물 금값은 전일 대비 33.20달러(1.45%) 상승한 온스당 2,315.0달러에 거래를 마감했다. 이는 종가 기준 1974년 계약 체결 이후 최고 수준이다.

이날까지 금가격은 5거래일 연속(2,212.70→2,238.40→2,257.10→2,281.80→2,315.0) 종가 최고치를 경신했다.

금값이 2300달러 선을 넘은 것도 사상 최초다. 장중 금가격은 2,280.0~2,320.00달러 부근에서 움직였다.

이날 귀금속 시장은 파월 연준 의장의 발언에 주목했다.

파월 의장은 이날 스탠퍼드대에서 열린 포럼 모두발언에서 "인플레이션에 대해 말하자면, 최근 지표가 단순한 요철 이상을 의미하는지 판단하기는 아직 너무 이르다"라고 말했다.

그는 이어 "인플레이션이 목표 수준인 2%로 지속해 둔화하고 있다는 더욱 큰 자신감을 가지기 전까지는 기준금리를 낮추는 게 적절하지 않다고 생각한다"고 말했다. 또, "현재까지 견조한 성장세와 인플레이션 진전에 비춰볼 때 정책 결정에 도움을 줄 추가적인 지표를 기다릴 시간이 있다"며 "올해 어느 시점에 기준금리 인하를 시작하는 것이 적절할 것으로 본다"고 덧붙였다.

파월 의장의 이 같은 발언은 지난달 20일 연방공개시장위원회(FOMC) 후 기자회견 발언에서 크게 바뀌지 않은 것이다. 연준의 마지막 정책회의가 있었던 3월 20일 기자회견과 비슷한 내용을 반복했다.

파월이 금리 인하에 대한 기존의 입장을 유지했지만, 귀금속 시장은 크게 개의치 않은 분위기다. 금가격은 장중 한때 온스당 2,321.80달러까지 치솟았다.

|

전문가들은 금 시장 참가자들이 인플레이션 반등 또는 미 연방준비제도(Fed·연준)의 조기 금리 인하에 베팅하고 있다고 보고 있다. 최근 인플레이션이 상승세를 보이면서 일부 전문가들은 연준의 금리 인하 시점을 미루고 있지만, 투자자들은 여전히 6월 11~12일 연준의 정책 회의에서 첫 번째 금리 인하를 기대하고 있다.

금값은 통상 인플레이션 기대가 높아지거나 금리가 낮아질 때 상승하는 경향이 있다. 위기 상황에 대비해 안전한 투자자산으로 금을 찾는 수요도 있다.

달러화 가치도 이틀 연속 약세를 나타내며, 금값을 지지했다. 주요 6개 통화에 대한 달러화 가치를 반영하는 달러인덱스는 전장보다 0.485% 낮아진 104.271을 기록했다. 달러화 하락은 통상 달러로 거래되는 금의 체감가격을 낮춰 해외바이어들의 매수심리를 자극하는 금의 우호적인 요인이다.

미국의 재정적자 심화도 인플레이션 재개 우려와 맞물려 금 가격 상승을 부채질하고 있다.

헤지펀드인 그린라이트 캐피털의 창업자 데이비드 아인혼은 이날 CNBC 인터뷰에서 "물가 상승 속도가 다시 빨라지고 있다"며 "금에 많은 투자 비중을 할애하고 있다"라고 말했다.

그는 "미국의 통화정책과 재정정책 전반에 문제가 있는 상황이고, 궁극적으로는 재정적자가 진짜 문제라고 판단한다"며 "뭔가 안 좋은 일이 벌어지고 있을 때 금은 위험을 헤지(위험회피)할 수 있는 방법"이라고 덧붙였다.

금가격은 올해 들어 11% 이상 상승했다. 중동의 지정학적 리스크를 비롯해 글로벌 중앙은행의 외환보유고 증가, 투자자금 유입, 우크라이나 지정학적 리스크 고조, 미국 대선 불확실성, 미·중 전략적 경쟁 심화 등이 금시세 상승세를 뒷받침하고 있다.

뉴욕에 본사를 둔 독립 금속 거래자인 타이 웡(Tai Wong)은 "파월이 도로의 '충격'이 전반적인 장밋빛 그림을 바꾸지 않는다는 점을 강조한 이후 거래량 증가로 금값이 또 다른 역사적 최고치로 급등했다"고 말했다. 그는 또 "파월의 관례적인 신중한 접근 방식은 금 강세자들은 걱정하지 않는다"며 "강세론자들은 2,300달러를 기대해왔고, 더 많은 투자자들이 금 거래에 참여하고 있다"고 덧붙였다.

귀금속 투자자들이 기다리고 있는 미국 3월 고용 보고서는 오는 5일 발표되며, 새로운 인플레이션 데이터는 다음 주에 발표될 예정이다.

한편, 은 가격은 4.38% 상승한 27.060달러로 2년 만에 최고치를 기록했다. 구리는 3% 오른 4.1940달러를 나타냈다. 플래티넘은 1.7% 상승한 931.13달러, 팔라듐은 1.2% 상승한 1,015.70달러를 나타냈다.

이 시각 국제 금값시세(오전 9시 50분 기준, 런던 LBMA 금값시세)는 2,300달러 선에 움직이고 있다.

국제 금값 상승에 따라 국내 금가격도 신고가를 경신했다.

4일 한국금거래소 따르면 소비자가 순금 1돈(24k, 3.75g) 살때 가격은 전장 대비 0.47%(2000원) 상승한 424,000원(VAT포함)이다(오전 9시 50분 기준). 이는 2005년 1월 한국금거래소 개장 이래 장중 역대 최고치다.

소비자가 순금 1돈 팔때 가격은 전장과 같은 376,000원이다. 18k, 14k 팔때 가격도 각각 276,400원, 214,300원으로 전 거래일과 같은 수준이다(18k와 14k 살때는 제품시세를 적용한다).

이 밖에 은 살때 시세는 전 거래일 대비 3.47% 오른 5,180원, 팔때는 3.4% 상승한 4,120원을 기록했다. 백금 살때 가격은 전일보다 1.13% 오른 177,000원, 팔때 가격은 1.4% 상승한 143,000원이다.

한국거래소(KRX) 금가격도 연일 역대 최고치를 경신하며, g당 10만7천원선을 돌파했다.

KRX 금값은 전일 종가 대비 1.91% 오른 g당 107,000원을 나타내고 있다(오전 9시 50분 기준). 이는 2014년 3월 24일 KRX 금시장이 거래를 시작한 이래 장중 가장 높은 수준이다.

신한은행 금시세는 0.49%(483.94원) 상승한 99,470.66원에 거래되고 있다.

서울 외환시장에서 원·달러 환율은 전 거래일보다 5.4원 내린 1343.5원으로 거래를 시작했다.

자세한 국내 금시세 조회는 한국금거래소와 한국거래소(KRX) 홈페이지 등에서 확인 가능하다.

/뉴미디어부 주홍철 기자 jhc@kjdaily.com

-다음은 위 기사를 영어로 번역한 전문이다. 번역에 오류가 있을 수 있다.

-3-day international gold price 1.45%↑

Today’s gold price (Korea Gold Exchange 0.47%↑, Korea Exchange-KRX 1.91%↑)

The international gold price surpassed the $2,300 per ounce level for the first time in history, hitting an all-time high. Despite Federal Reserve Chairman Powell's cautious remarks about interest rate cuts, gold prices continued their bull market.

On Wednesday (the 3rd local time) at the New York Mercantile Exchange (COMEX), this year's June gold price closed at $2,315.0 per ounce, up $33.20 (1.45%) from the previous day. Based on the closing price, this is the highest level since the contract was signed in 1974.

Until this day, the gold price broke the highest closing price for 5 consecutive trading days (2,212.70 → 2,238.40 → 2,257.10 → 2,281.80 → 2,315.0).

This is the first time in history that the price of gold has exceeded the $2,300 level. Intraday gold prices moved around $2,280.0 to $2,320.00.

On this day, the precious metals market paid attention to Federal Reserve Chairman Powell's remarks.

Chairman Powell said in opening remarks at a forum held at Stanford University on this day, "As for inflation, it is still too early to judge whether the recent indicators indicate more than just bumps."

He continued, “I don’t think it is appropriate to lower interest rates until we have greater confidence that inflation is continuing to slow to the target level of 2%.” He added, “Given the solid growth and progress in inflation to date, there is time to wait for additional indicators to help guide policy decisions,” adding, “We believe it would be appropriate to begin cutting interest rates at some point this year.”

Chairman Powell's remarks remain largely unchanged from his remarks at a press conference after the Federal Open Market Committee (FOMC) on the 20th of last month. Similar content was repeated from the press conference held on March 20, when the Fed's last policy meeting was held.

Although Powell maintained his previous stance on interest rate cuts, the precious metals market appears to be unconcerned. The price of gold soared to $2,321.80 per ounce at one point during the day.

Experts believe gold market participants are betting on a rebound in inflation or an early interest rate cut by the U.S. Federal Reserve. With inflation recently on the rise, some experts are delaying the timing of the Fed's rate cut, but investors are still expecting the first rate cut at the Fed's policy meeting on June 11-12.

Gold prices usually tend to rise when inflation expectations rise or interest rates fall. There is also a demand for gold as a safe investment asset in preparation for crisis situations.

The value of the dollar also weakened for two days in a row, supporting the price of gold. The dollar index, which reflects the dollar's value against six major currencies, recorded 104.271, down 0.485% from the previous day. The decline in the dollar is a favorable factor for gold, stimulating the purchasing sentiment of overseas buyers by lowering the perceived price of gold, which is usually traded in dollars.

The worsening fiscal deficit in the United States, coupled with concerns about a resumption of inflation, is fueling the rise in gold prices.

David Einhorn, founder of hedge fund Greenlight Capital, said in a CNBC interview that day, “The pace of price rises is accelerating again,” and “We are allocating a large portion of our investments to gold.”

He said, “There is a problem with the overall monetary and fiscal policy of the United States, and ultimately, I believe that the fiscal deficit is the real problem.” He added, “Gold can hedge risks when something bad is happening.” “There is a way,” he added.

Gold prices have risen more than 11% this year. The rise in gold prices is supported by geopolitical risks in the Middle East, increased foreign exchange reserves of global central banks, inflow of investment funds, heightened geopolitical risks in Ukraine, uncertainty in the U.S. presidential election, and intensifying strategic competition between the U.S. and China.

“Gold prices surged to another historic high on increased trading volume after Powell emphasized that the ‘shock’ on the road does not change the overall rosy picture,” said Tai Wong, an independent metals trader based in New York. . "Powell's customary cautious approach does not worry gold bulls," he said. "The bulls have been hoping for $2,300, and more investors are participating in gold trading."

The US March employment report, which precious metals investors are waiting for, will be released on the 5th, and new inflation data will be released next week.

Meanwhile, the price of silver rose 4.38% to $27.060, hitting the highest level in two years. Copper rose 3% to $4.1940. Platinum rose 1.7% to $931.13, and palladium rose 1.2% to $1,015.70.

At this time, the international gold price (as of 9:50 am, London LBMA gold price) is moving around the $2,300 level.

As the international gold price rose, the domestic gold price also broke a new record.

According to the Korea Gold Exchange on the 4th, when a consumer buys 1 dong (24k, 3.75g) of pure gold, the price is 424,000 won (VAT included), up 0.47% (2,000 won) from the previous price (as of 9:50 a.m.). This is the highest intraday price since the opening of the Korea Gold Exchange in January 2005.

When a consumer sells 1 dong of pure gold, the price is 376,000 won, the same as the battlefield. When selling 18k and 14k, the price is 276,400 won and 214,300 won, respectively, the same level as the previous trading day (when buying 18k and 14k, the product market price is applied).

In addition, the price when buying silver was 5,180 won, up 3.47% from the previous trading day, and when selling silver, it was 4,120 won, up 3.4%. The price to buy platinum is 177,000 won, up 1.13% from the previous day, and the price to sell it is 143,000 won, up 1.4% from the previous day.

The price of gold on the Korea Exchange (KRX) also broke all-time highs day after day, exceeding the 107,000 won per gram mark.

The KRX gold price is at 107,000 won per gram, up 1.91% from the previous day's closing price (as of 9:50 a.m.). This is the highest intraday level since the KRX gold market began trading on March 24, 2014.

Shinhan Bank gold price is trading at 99,470.66 won, up 0.49% (483.94 won).

In the Seoul foreign exchange market, the won-dollar exchange rate began trading at 1343.5 won, down 5.4 won from the previous trading day.

Detailed domestic gold price inquiries can be found on the Korea Gold Exchange and Korea Exchange (KRX) websites.

/New Media Department Reporter Joo Hong-cheol jhc@kjdaily.com

주홍철 기자 jhc@kjdaily.com